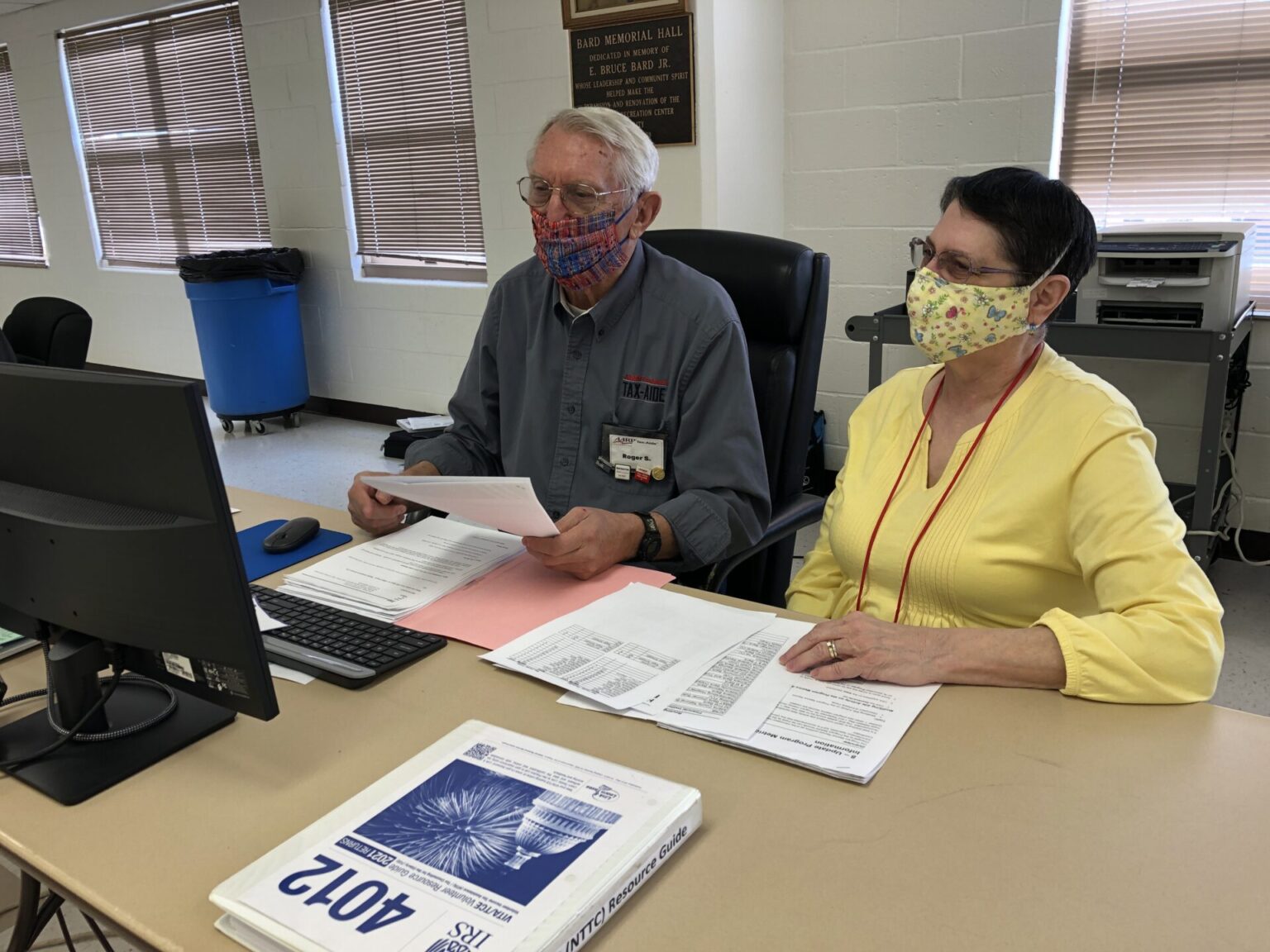

Clients visiting a IRS/AARP (Internal Revenue service/American Association of Retired Persons) Tax Aide program site should feel “they’re in the right place to get help.”

That’s the goal of Roger Schwalm of Shippensburg, head of operations for the programs in Franklin and Fulton counties.

Schwalm, a volunteer for the past 19 years, also wants to make certain they “feel good when they leave.” His most important message: “We did over 3,200 returns last year that accounted for $2.8 million in refunds, money that went into their pocket at no cost.”

The nationwide tax help program is aimed at those who have low to moderate incomes, but Tax-Aide is open to anyone free of charge and you don’t need to be an AARP member. Tax-Aide’s 36,000 nationwide volunteers are certified by the IRS; the deadline to file a federal return is April 19.

Clients range in age from “high school kids flipping burgers who shouldn’t have to pay to have their taxes prepared” to centenarians. “Last year we had a 101-year-old client and two people who were 100-years-old,” Schwalm said.

Appointments and masks are required and sites, their hours of operation and toll free phone numbers include: Waynesboro American Legion, 63 E. Main St., starting Feb. 4, on Mondays and Fridays from 9 a.m. to 3 p.m.; Chambersburg Recreation Center, 235 S. Third St., starting Tuesday, Feb. 1, on Mondays, Tuesdays, Thursdays and Fridays, from 8 a.m. to 3 p.m. “Those sites share four phone numbers, 223-842-1689, 223-842-1692, and 223-842-1696, as well as 717-263-5479, a line donated by CenturyLink. When you call for an appointment, you have to tell them which site you want to visit.”

In McConnellsburg, the site is located at American Legion Post 561 at 411 N. Fifth St. Hours are 8:30 a.m. to 2 p.m. only on Wednesdays, started Feb. 2, and the phone number is 223-842-1701

“I encourage callers that if they don’t get through right away, keep calling. You will get through and get an appointment. Everything depends on the number of volunteers we have in the call centers,” he said.

The 72 Franklin and Fulton county volunteers include greeters and tax preparation aides, who expect to file close to 3,500 returns for residents of the two counties, according to Schwalm.

“The work is all computerized. We use Chromebooks provided by AARP and the IRS provides the software. Volunteers have to pass the (40- to 50-hour) course and a test by the IRS. It’s a massive amount of information and you have to be aware of new tax laws.” The course moved from in-person learning to Zoom meetings, Schwalm added. ”We record the presentation, cover topics in an hour, and break the presentations into subject matter. That way if the volunteer doesn’t understand something, they can go back and look at just that one hour. They don’t have to wade through everything if they have a specific question.”

Schwalm said his volunteer stint started after he retired as a security specialist with The Secret Service in 2001. “My wife, Linda, said ‘I’m going to quilt and you’re going to find something to do.’

“I enjoy the work and we all feel the same way,” said Schwalm, a checker who volunteers as many as five days a week as well as one day on weekend. “You’re tired at the end of the (10-week) season. We have a big banquet the day after tax season closes as a way to thank those people involved.”

Sessions may start with clients being “really concerned. You can see it in their face and their demeanor as we go through the process. When the return is done and checked and we say, ‘Where would you like your refund deposited, it makes it all worthwhile. We never talk religion or about their salaries. We develop a rapport with them, but stress, ‘You have to be honest. We need all your information. If there’s a problem, the IRS is coming back to you, not us.’”

Schwalm said he is “always looking for volunteers.” Those interested may call 717-532-9086.