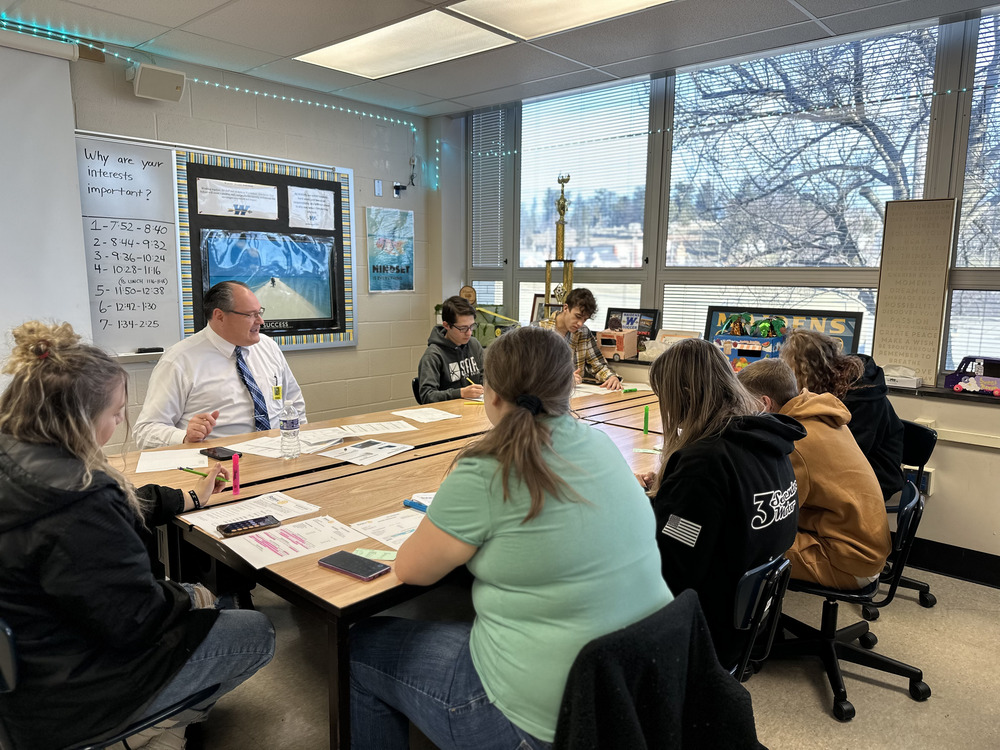

WAYNESBORO–One of the least understood areas in many people’s lives is how their finances work. “When I was a kid, my parents told me I didn’t need to know anything about the budget they prepared at the kitchen table,” said Dan DeDona, Rotary Club of Waynesboro’s lead for the Financial Literacy Course. “Most of us get a real life introduction when we get loans for cars or homes, or pay bills. Sometimes that is not a pleasant lesson.”

The Rotary Club offers this course to seniors twice each year. More than 100 students particpated in the recent class.

During the event, students are broken into two groups, with half participating in a Budget Builder exercise for two hours in the morning, while the other half participates in a series of games that offer lessons in finance. In the afternoon, the groups swap.

At the end of the day, game winning teams were awarded gift cards. The whole group also competed for movie tickets by answering questions they should have come to appreciate over the course of the day. “Bill Kohler (a Rotarian) and Mainstreet Waynesboro are very generous each session providing these awards for good performance,” said DeDona.

“Participating learners generally like the course” said Kegan Crider, WASD point of contact for the course. He and Eda Gjikuria asked students the following day about their experiences. According to Gjikuria, they very much appreciated having experienced people take the time to explain many things about their money, how to think about it, and how to manage it.

Although a Rotary-led activity, the event draws support from throughout the community. “People from Edward Jones, Blue Ridge Risk Partners, Orrstown Bank, F&M Trust, Sterling Financial and Waynesboro Early Learning Center return year after year to participate,” said DeDona.

The school district collaborates with the club to make all this happen by providing rooms, print material for the course, and scheduling students to work their way through the different activities. The club provides volunteers (18 this time) to see to it that students get the intended lessons.

“It’s a big deal on both sides,” said Crider. “While we offer personal finance instruction for our learners, there is nothing like having experienced adults with backgrounds in finance, budgeting, investing, insurance, and other areas come in to interact directly with seniors who will be on their own in a short time.”

“At the end of the day, it’s all about preparing our learners for the next step in their lives,” said Rita Sterner-Hine, incoming superintendent of WASD. “We appreciate the time and effort, a full day each time, that so many from the community provide for our learners.”